The US Federal Reserve has been considering having a central bank digital currency, CBDC, and has just released a position paper on the subject. They note that an electronic form of central bank money would promote financial inclusion, make domestic and international payments faster and provide a platform for innovative financial services and products. When will we have a US digital currency? What drawbacks does the Fed anticipate?

US Digital Currency Benefits Versus Concerns

The Fed position paper regarding a central bank digital currency notes that such a tool would be “analogous to a digital form of paper money.” It would be available to the general public as a “convenient electronic form of central bank money.” It should have sufficient liquidity and a strong level of security. And, they raise concerns about how a US digital currency would affect the structure of financial markets, availability and cost of credit, how safe and stable the financial system will be, and how it would help or hinder the effectiveness of US monetary policy. And, the Fed notes that such a financial vehicle will need to verify identities in order to combat money laundering and use of the system for purposes of terrorism.

When and Not If There Will Be a US Digital Currency

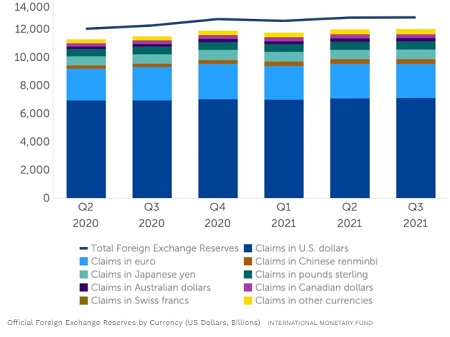

In December of 2021 House Financial Services Committee held a large educational session regarding digital assets. A repeated concern was how to maintain the global dominance of the US dollar in the face of rising use of cryptocurrencies and digital currencies of other central banks. It would appear that much of the delay in implementing a US digital currency has to do with the large number of regulatory agencies that could be involved in such a project and getting them to agree on a single approach and set of rules. There has been talk of setting up a single regulatory agency for this purpose. The President’s Working Group on Financial Markets issued a report on the subject in which it recommended OCC and FDIC collaboration.

Who Is Working On a Digital Dollar?

The Boston Federal Reserve has been working with MIT in an effort to develop a workable technical standard for a US digital currency. Likewise the New York Fed is working with the Bank of International Settlements Innovation Hub, the Federal Reserve System, and private sector experts to design a workable approach to a US digital dollar. As the old saying goes, the devil is in the details and in order to get a system that serves its desired purpose and does not get hacked by Russians, Iranians, North Koreans, or whoever a lot of work needs to be done so that when we have a US digital currency it is useful and safe.

Effect of a US Digital Dollar on Cryptocurrencies

A US digital dollar will be used for online transactions like cryptocurrencies but not require a third party. And, the US dollar will not be subject to wild swings in price like in the world of bitcoin and others. It will not be useful for money laundering or financing terrorism either. It is our opinion that when there is a functioning US digital currency that it will not be a knife to the heart of bitcoin and other cryptocurrencies. That is because, despite bitcoin being invented to make financial transactions online easier, its use today is for financial speculation for the majority of people and avoiding taxes and hiding money for nefarious purposes for others.

FREE MASTERCLASS: 3 Secrets to Take Control of Your Financial Future!