Such is the power of the US Federal Reserve and its ability to set interest rates that stock prices often move counter to what one would rationally expect. For example, the jobs report indicates lower employment and a potential recession, but stocks go up. This is because traders expect the Fed to lower interest rates and therefore stimulate the economy. While such thinking has often profited traders and investors over time, the matter of interest rates and your investing is not that simple. In fact, in the coming months and years the expectation that the Federal Reserve will remain all powerful in determining rates may not serve the interests of the investing public. How is that?

Factors That Drive Interest Rates

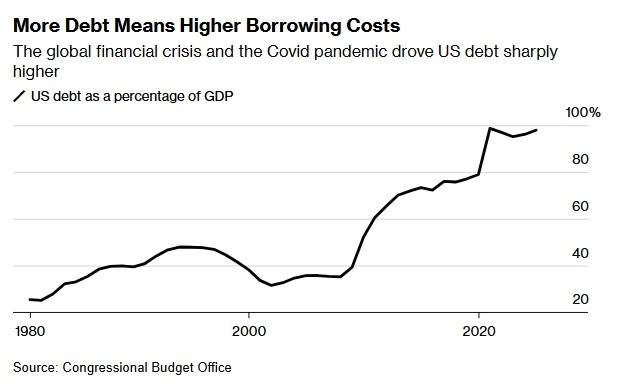

Bloomberg offers some insights into what factors determine interest rates in a recent article entitled Trump’s Interest Rate Obstacle Is Bigger Than Powell. They note that the demographics of aging and population, steadily rising debt, and deglobalization are all likely to cause rates to go up no matter what the Fed may to in setting rates. As is commonly the case supply and demand are eventually in control. Available savings from US Baby Boomers will no longer be financing debt and as China and the US move apart, China may stop putting its excess money into US treasuries. These factors would reduce supply at the same time that governments and individuals are piling on debt and will need to borrow more for defense, tax cuts, and projects like artificial intelligence.

Higher rates are the result of far more than Fed decisions. Debt, demographics, and deglobalization are all driving the price of money up.

US Treasury Auctions Help Set Interest Rates

Because the US government carries a significant debt it has to sell US treasuries to get money to keep operating. It does this via auctions. Those investors who participate place bids. These are based on the value of the securities based on anticipated economic conditions and the value of the security over time. No matter what the Fed does in setting bank rates, the interest rates in treasuries is likely to go up if the total pool of money to lend is drying up and the demand for loans goes up as anticipated.

Federal Reserve Independence

The USA has traditionally been the most secure place for investing. A large part of this comes from the independence of the US Federal Reserve. According to the Brookings Institution, the US Federal Reserve was set up in 1913 to be an independent body charged with maintaining financial stability. In 1977 maintaining maximum employment was added to its mandate. It would require Congress to change the law in order for the Fed to lose its independence. Nevertheless, every time President Trump talks about firing the head of the Federal Reserve and appointing someone who would cut interest rates under Trump’s order market fall. The traditional independence of the Fed is a key factor in US economic and financial stability. Where this comes into the interest rate picture includes the rates of interest and investors are willing to accept in return for buying US treasuries.

Long Term High Interest Rates and Your Investing

When interest rates are high for a prolonged period, the US and global economy stagnate. While the Fed can set official short term rates they cannot force investors to accept interest rates that are not advantageous. They cannot make governments and businesses stop borrowing money and piling on debt. Thus the basic issues that set long term rates are likely to continue to function into the future which will make the economy and investments in stocks suffer. To the extent that one trusts the US government to honor its debt, a preferable investment may well be higher-interest US Treasuries.