Sometimes the world of investing makes sense. Sometimes, like now, it seems like a modern version of Alice in Wonderland where Alice says, “Why, sometimes I’ve believed as many as six impossible things before breakfast.” Other times the comment of the caterpillar seems appropriate for American politics and finance, “We’re all mad here.” Specifically, in this economic topsy-turvy investing world we are wondering, are treasury bills safe investments?

What Normally Constitutes a Safe Investment?

A safe investment preserves its dollar value and keeps up with inflation. A few years ago we wrote about how to invest without losing any money. The point we made was that some investments, like stocks, can appreciate nicely over time. They can also fall in value at very inconvenient times. We noted that the best way to protect the dollar value of your investments was with deposits insured by the Federal Deposit Insurance Corporation (up to $250,000 per account) at your local bank. The next best choice, we said, was with Treasury bills, notes, and bonds. By staying with short term securities you retain the ability to change your investments to stay ahead of inflation. Unfortunately, that approach may not work today. The problem with this approach today is two-fold. These investments assume that the dollar will not collapse nor will the US government fail to meet its obligations and pay what they have promised.

Is It Time to Worry About the Dollar and the US Government?

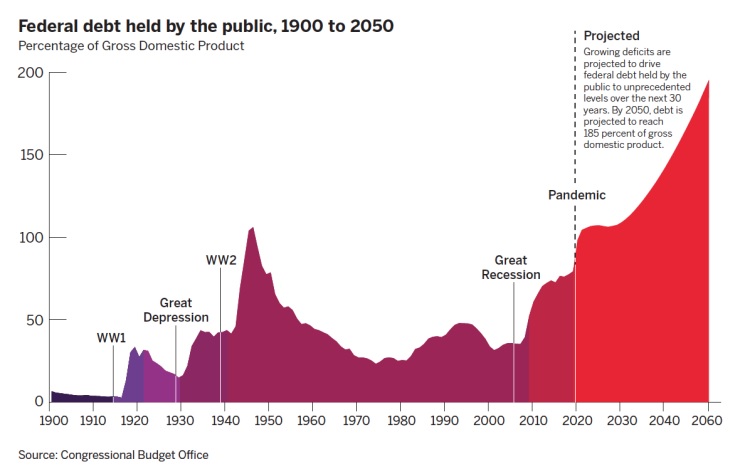

The problem that is looming over today’s investing landscape is the US debt crisis and the distinct possibility of a US government debt default. The government ran out of money a couple of months ago and the US Treasury has been shifting payments around to make ends meet. According to Secretary Yellen, this will work until June or perhaps July and then the US will begin to default on debt payments.

Why we think it is time to worry is this. The argument presented to the American people has to do with raising taxes and/or cutting spending. However, the legislation that has been proposed to raise the debt ceiling and forestall a debt default includes items that do not do either of these things. What we are seeing is a dangerous game of “chicken” with two cars speeding down the highway toward each other to see which one swerves first. This is a bad idea for drunken teenagers and what we are seeing in Congress is unforgivable for leaders of the United States of America.

Does the Dollar Collapse with a Debt Default?

There are a lot of dollars in the world. There are about $2.342 trillion in notes and coins in circulation. The US has $45.45 billion in gold reserves. (8,133 tons) Compared to these monetary assets, there are about 30 trillion US dollars owed in US Treasuries. The problem is that in the modern world the vast majority of monetary assets are essentially credit. This includes dollar reserves held by nations around the world and anyone who has put their money into US Treasuries or bank accounts relying on the full faith and credit of the US government.

The financial system depends on trust in the value of currencies and especially on the value of the dollar. It depends on people believing that when they want to cash in a CD or US Treasury bill that they will be paid. And it depends on them believing that the purchasing power of that dollar will be somewhere in the neighborhood of what they expected. Historically, when a national currency is in peril because of a likely debt default people buy dollars. Today they may buy euros, British pounds, Swiss francs, yen, or yuan.

The problem with treasury bills as a safe investment is that people lose the necessary level of trust, they will buy other currencies and send the dollar down in value. Anyone with anything to sell will demand more dollars because they will expect the value of the U.S. dollar to fall. This will turn into a self-fulfilling prophecy and the dollar could, in fact, collapse. Then the Treasuries that you want to redeem will have substantially less real world value than you expected. That assumes that the government actually has the money to pay you because it has defaulted on its debts because the political game of “chicken” ended very poorly.

Are Treasury Bills Safe Investments? – SlideShare Version