Fifty years ago China was an agrarian society and today it is the largest industrial power in the world. Fifty years ago China was preoccupied with walling itself off from the world and today it is seeking influence and power across the length and breadth of the world. The problem as seen from the viewpoints of many countries is that China seeks to dominate and control instead of working with other nations. The ten year risk from China to your investing has to do with China’s power peaking and the possibility that its aging leader, Xi Jinping, will believe that he is running out of time and will push too hard, causing an armed conflict as a worst case scenario or a total economic rupture as another devastating scenario. Less intense scenarios include the supply chain nightmare caused by outsourcing so much manufacturing to China and China’s control of so much of the world’s raw materials. We look at China’s goals and risks in regard to your ten year risk from China to your investing.

What Does China Want?

The Chinese Communist Party runs things in China and would just as soon run as many things in the world as it can. This includes, as noted in an article in The Atlantic, its wish to rule the world by controlling the rules. The rules developed by the US and its allies after World War II were sufficient to prevent another world war. It is not clear that rules devised by China strictly for its own benefit would have the same degree of success. China does not work under sets of laws but rather uses laws to control their population and sustain the Communist Party in power. The bottom line for China is that it wants to dominate and control forever. The concern is that they will cross a line at some point that leads to global conflict and total disruption of the economic system taking your investments with them. Meanwhile they have come to dominate critical raw materials and manufacturing like lithium batteries and many strategic minerals.

Global Control Through Debt

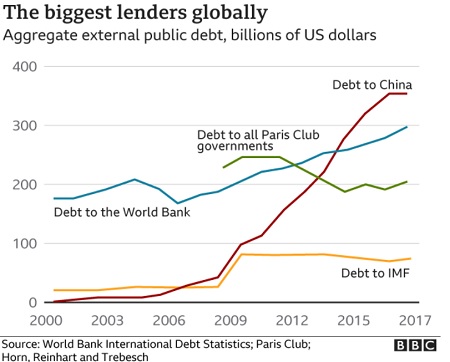

China pursues a two-track approach to building global infrastructure. It lends money to poor nations to pay for large projects like railroads, ports, and mining operations which are built by Chinese workers. China then benefits by getting the raw materials mined and using the infrastructure to complete goals like its belt and road initiative linking Chinese factories to markets across Asia and Europe. Meanwhile these nations sink into debt and increases vulnerability to Chinese dominance. A BBC article highlights the issue of unsustainable debt to China in poor nations with debt to China surpassing debt to the IMF, Paris Club government, and World Bank by 2017.

Limited Time for Chinese Global Dominance

At the end of the 1980s Japan seemed poised to dominate the world technologically and financially. Then the hidden debt that had helped finance Japan’s rise came back to bite them and Japan sank into a deflationary cycle from which it has never really recovered. While China exerts control through debt over poor nations across the world China faces a looming debt crisis of which we are seeing the first wave with the real estate sector crisis whose poster child is Evergreen.

Magnitude of Chinese Debt Problems

While the amount of debt owed to China by poor nations paying for infrastructure projects is approaching a trillion dollars the debt owed by China’s government comes closer to $7 Trillion (CN¥ 46 trillion) which is about 45% of their GNP. Chinese household debt runs at about $4.3 Trillion, of which most is mortgage debt. The problem with this debt is that should the Chinese real estate market collapse, like in the US with the Financial Crisis, the number of households “upside down” on their mortgages could run to many more than in the US a decade or more ago. But, Chinese corporate debt dwarfs both the government and household debt China coming in at $27 Trillion.

The possibility of China following Japan’s example from economic success to near-collapse is not lost on the Chinese government. Thus, Chinese leaders must confront the fact that their power is peaking this decade as other nations adopt an “anywhere but China” approach to manufacturing and build military alliances specifically to confront China.

Investing Fallout in Regard to China

How could all of this affect the average investor? Chinese stocks listed on US exchanges could disappear in a pivot away from Wall Street. A Chinese financial collapse due to their huge debts would send the entire world economy into a recession on top of the permanent Covid crisis. Investing in the US and especially in companies that will benefit from coming infrastructure spending stands out as the first defense of investors against the ten year risk from China to your investing.

Ten Year Risk from China to Your Investing – China’s Goals and Risks – Slideshare Version