Bitcoin is a popular investment with more than one hundred million people worldwide invested in the senior cryptocurrency. In the last year investment in Bitcoin has become possible via exchange traded funds. In regard to this new opportunity, are Bitcoin ETFs good investments?

Bitcoin Investment Risks

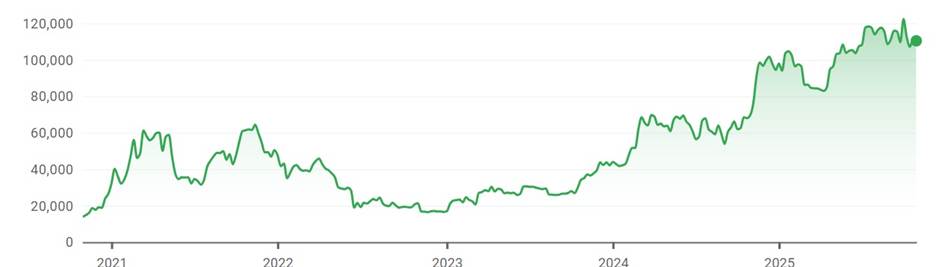

In regard to Bitcoin ETFs there are really two issues. Is Bitcoin a good investment and is an ETF a good way to invest in Bitcoin? Over the last five years Bitcoin has gone from $20,000 to $110,000. Along the way it has experienced significant price fluctuations. It had a peak of $64,000 in late 2021 and a bottom of $16,000 in late 2022 at the depth of “crypto winter.” Then it proceeded to recover to $64,000 in early 2024 and to $110,000 today. Anyone who got into Bitcoin at one of its price valleys and has held on has seen excellent gains. Anyone who bought during a price surge due to FOMO, fear of missing out, and then sold when the price fell again has had a terrible investing experience. Thus, a significant issue for Bitcoin investors is fact that Bitcoin has been prone to huge price swings both up and down.

Bitcoin Trading Risks

Due to Bitcoin’s tendency to fluctuate widely in price many choose to try to time their purchases and sales of Bitcoin. They trade instead of invest. A significant risk for these folks is Bitcoin wash trading. This is market manipulation by traders who simultaneously sell and buy Bitcoin. Traders who do this in the stock market are often aiming to get a tax write off on a loss because they had purchased a stock that subsequently fell in price. Then they repurchase at a bargain price. If the IRS catches you doing this you will not get a tax write off. It is, in the stock market, illegal. But it happens in the Bitcoin market every day. The issue for trading Bitcoin is that wash trading can distort the price of Bitcoin giving unwary traders the impression that the market is likely to go up due to greatly increased trading volume. Anyone who buys when they see the trading volume surge is just as likely to lose money as to gain money. Thus, wash trading poses a significant risk for those seeking to time the Bitcoin market.

Using an ETF to Invest in Bitcoin

Exchange traded funds are a popular investment vehicle. An ETF hold assets such as bond, commodities like gold, or stocks. They are set up to track the value of the assets they hold so that, for example, an the price of a share of an ETF that tracks Bitcoin will go up or down proportionally with the price of Bitcoin. ETFs are attractive for investors who do not want do deal directly in cryptocurrencies, do not want a have a crypto wallet or do any of the things necessary to buy and sell Bitcoin directly. They buy and sell shares of the ETF just like they would buy and sell shares of any stock. In addition ETF shares can be held in investment accounts like an IRA thereby avoiding taxes until retirement. This approach allows one to avoid the risks of holding Bitcoin directly. One of “downsides” of using an ETF to invest in Bitcoin is that the ETF will charge a management fee. It is important to compare fees when choosing an ETF for your Bitcoin investments.

Bitcoin ETFs

VettaFi lists twenty-five Bitcoin ETFs. These include:

iShares Bitcoin Trust ETF, Fidelity Wise Origin Bitcoin Fund, Grayscale Bitcoin Trust ETF, Grayscale Bitcoin Mini Trust ETF, ARK 21Shares Bitcoin ETF, Bitwise Bitcoin ETF Trust, ProShares Bitcoin ETF. ARK Next Generation Internet ETF, 2x Bitcoin Strategy ETF, VanEck Bitcoin ETF. And BITU ProShares Ultra Bitcoin ETF. This site provides useful comparison information about Bitcoin ETFs.