A news item caught our eye the other day. An early investor in Bitcoin known for his almost evangelical promotion of the cryptocurrency got the nickname “Bitcoin Jesus.” His name is Roger Ver and he is in the news, not for promoting Bitcoin, but for allegedly not settling an options trade on Bitcoin. This bit of news points out one more crack in the cryptocurrency system that needs attention and, specifically, why Bitcoin options need regulation. When an options trader buys and sells options on stocks or currencies, the trades pass through a clearinghouse that guarantees settlement. This critical step in options trading is typically missing in the crypto world.

Genesis Tracking Down Assets

The Genesis DeFi business, which is also in trouble, is upset with Roger Ver, AKA “Bitcoin Jesus,” because they say he failed to settle a Bitcoin options trade. The parent company of Genesis, GGC International Limited, is in court seeking $20.9 million in damages plus court costs and expenses from Mr. Ver according to Bloomberg. This is the second time that GGC has had issues with Ver. Less than a year ago they said he did not pay on a margin call. Those who are not familiar with how stocks and options are traded may be lost at this point.

Function of a Clearing House in the Stock, Futures and Options Markets

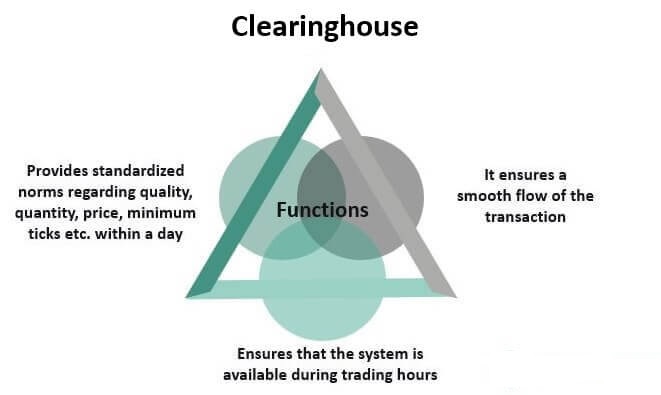

A financial clearing house is an intermediary between buyer and seller. These intermediaries exist in the New York Stock Exchange, Nasdaq, futures markets for commodities and stocks, and options markets. They are responsible for clearing trades, maintaining and collecting margin money, settling trading accounts, and reporting trading data. In futures markets they also regulate delivery of commodities. A clearing house takes the opposite side of each position in every trade acting as a middleman.

For the CBOE which handles options trading for stocks, commodity futures and more, the clearing house function is handled by the Options Clearing Corporation (OCC). In regard to our concerns about crypto options, both Bitcoin and Ether have both futures trading and options on futures trading on the CBOE and in both cases all of these trades are covered by the clearing house. The bottom line here is that if a party to a trade does not follow through with their obligations as stipulated by their trades, the clearing house as a last resort will cover their obligations. This is generally not the case with crypto options outside of CBOE!

Crypto Exchange Warning

Investopedia has a useful article about what they consider to be the best crypto exchanges including Coinbase. They also warn readers that crypto exchanges are unlike other brokers in that they may commingle trading funds with their general accounts making them potentially unsafe. They are not members of the Securities Investor Protection Corporation (SIPC). More to the point for trading options on cryptocurrencies or cryptocurrency futures is that these trades are generally not handled by a clearing house which makes one party or the other of a crypto futures options contract vulnerable should the other renege on their contract obligations.

How Options Work

In the world of options there are calls and puts. A call contract gives the buyer the right to purchase something like a stock or futures contract within the duration of the contract in return for a fee called a premium. A trader who thinks that the price of a stock or the value of a crypto token will go up in dollars will purchase a call and execute that contract if the expected price rise does happen. They are under no obligation to do anything if the prices do not go in the direction they expected.

A put contract give the buyer the right to sell a stock, crypto token, or futures contract within the timespan of the contract in return for a fee or premium. In both cases the sale price of the contract, called the strike price, is fixed, which makes it profitable to execute the contract when the price moves as anticipated.

In the cases of both calls and puts the seller is obligated to fulfill their part of the contract if the buyer wishes. This can be quite costly for the seller. The reason to have someone like a clearing house guarantee such trades is that financial losses can be substantial when one party reneges on their obligation.

The Point of Regulating Crypto Options Trading

Basically, the options markets are a formal and legalized way to bet on crypto prices. Brokers generally require traders to maintain an account from which they can engage in trading. When trades go badly a trader often needs to replenish their account and is asked to do this by the broker. This is a margin call. When someone does not do this, they end up owing money to the broker and/or the other party in trade. In the US stock, futures, and options markets, traders and investors are protected by layers of rules and regulations including the fact that all trades must pass through a clearing house. The situation with Genesis and “Bitcoin Jesus” simply highlights the need for these regulatory structures in the crypto world.

Why Bitcoin Options Need Regulation – SlideShare Version