The enemy of my enemy is my friend or so the saying goes. Today that applies to political opponents who are traditionally against each other’s proposals across the board. What has brought the likes of Elizabeth Warren, Lindsey Graham, Joe Manchin, and Wall Street banks together is the desire for tougher crypto rules regarding terrorism financing and money laundering. The goal of these folks is to include crypto and all digital assets within the jurisdiction of the framework of the Bank Secrecy Act and anti-money laundering rules. They want the issue of who are your crypto customers to be more tightly and completely regulated.

FREE MASTERCLASS: 3 Secrets to Take Control of Your Financial Future!

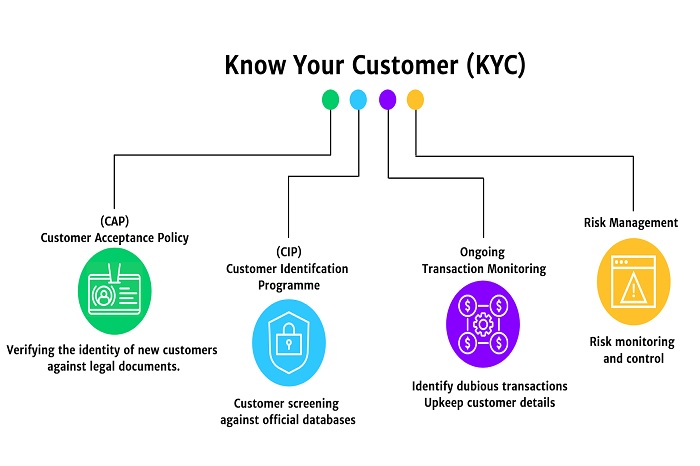

Know Your Customer in Crypto

The original idea with Bitcoin and subsequent crypto tokens was that folks could do business via the internet without dealing through middlemen. There was to be a degree of privacy in these transactions even though everything would be recorded on the blockchain. The problem as Warren, Graham, and Manchin see it is that bad actors have crept into the crypto realm and used the original idea of crypto to commit nefarious acts like financing terrorism or concealing gains from criminal activities. The first and best way to prevent these activities is for crypto businesses to know who their customers are. What Warren and the rest want is for providers of digital-asset wallets, miners, and others in the crypto system who use the blockchain to validate and make transactions secure to be responsible for validating all of their customer’s identities.

How Crypto Validation Should Work

The point of what legislators want is not only that crypto entities know who their customers are. Rather they want regulatory authorities such as the Commodity Futures Trading Commission, Securities and Exchange Commission, and Treasury Department, to set up examination processes to ensure that crypto entities are following the law and that bad actors are identified and dealt with. The ideal end point would be that those who would try to misuse crypto would not be granted access to the system.

Why Is This Alliance So Unusual?

Elizabeth Warren is a senator from the state of Massachusetts. Ever since the 2008 Financial Crisis she has been a thorn in the side of financial institutions who she blames for causing the crisis. She is constantly pushing for tighter regulations on banks and other financial entities. Her message has not really changed over the last 15 years. What has changed is that she has added crypto to her target list! This time around she has gathered support from many who generally oppose her ideas. This currently includes the National Consumers League, National Consumer Law Center, AARP, Massachusetts Bankers Association, and several other senators who more commonly are in opposition to her proposals.

Aren’t Crypto Businesses Already Doing KYC?

As a rule crypto businesses are supposed to be doing KYC or know your customer. The process involves collecting personal information from a customer and then independently verifying it. This process takes time, requires sufficient personnel to be assigned to the task, and costs money. As such there is a tendency to let this requirement slip. Every year there are fines levied against businesses including in the crypto realm for not complying adequately with KYC rules. What Warren and others are worried about is that a lot of issues are slipping through the cracks in the system and they want to tighten up regulation and oversight in this arena.

Who Are Your Crypto Customers? – SlideShare Version