Bitcoin has made a comeback from its crypto winter depths. Will it continue to climb, level off, or sink again? There are all sorts of economic headwinds that are likely to hurt the Nasdaq with which Bitcoin generally rises and falls. The potential for economic disaster with a US debt default seems to go up every day. What Bitcoin futures options tell us is that the options market is not predicting any substantial ups or downs out to June when the US will have to have dealt with the debt limit crisis or caused an international economic mess and a massive decline of the dollar. In other words, folks who trade options on Bitcoin futures are expecting a last minute deal they will avoid outright disaster.

Prediction Power of Bitcoin Futures Options

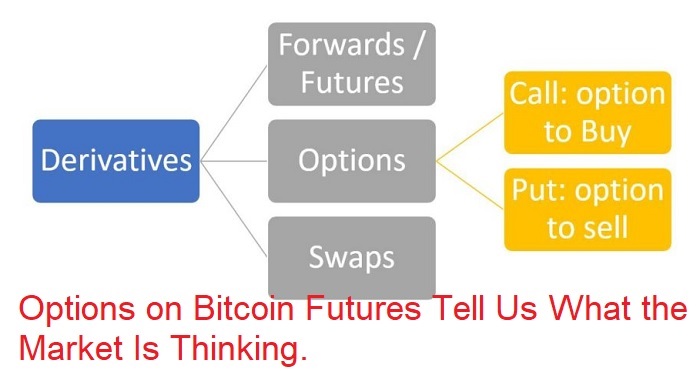

An important indicator in the stock market is the VIX, the Cboe Volatility Index. Often called the fear index, the VIX provides stock traders with a real time measure of how volatile the market will be in the coming month. It is based on calls and puts out a month and is recalculated daily. A call is an option contract giving a trader the right to buy a stock (or a Bitcoin futures contract) and a put is an option contract giving a trader the right to sell a stock (or Bitcoin futures contract). The specific calculation of the VIX is somewhat complicated but, basically, when options traders think the market will be in trouble, they buy puts so that they can sell their stocks in case of a market correction. When options traders are comfortable with the market, they will often buy call options which will give them the right to purchase stocks when the market goes up as they might be expecting. The point is that looking at what options traders are thinking and doing is a useful way to predict what the market will look like in the near term.

What Are June Bitcoin Futures Options Selling For?

We picked June for this discussion because that is when the US Treasury will run out of ways to move money around to keep the US from being unable to pay its debts. The US has not balanced its budget since the last years of the Clinton administration and before that since 1969. Ever since the late 1939s Congress has had to vote to raise the debt ceiling in order to stay in business. At times this has been routine and at times it has been high drama. This time around Republicans who control the House of Representatives are demanding budget cuts of favorite Democratic programs but not a rollback of the Trump tax cuts. Biden, the Democratic President is holding to the notion that raising the debt ceiling is not negotiable and that budget cuts, taxes, and the rest should be dealt with on their own. The game of “chicken” between House Speaker McCarthy and President Biden becomes increasingly risky as we count down to June.

The Markets Care When They Care and Not Before

We have seen time and time again that stocks, commodities, and cryptocurrencies trade up and down based on short term sentiment and without any worries about the bigger economic picture. Then the market wakes up and recognizes that a disaster might be in the making. Right how options on Bitcoin futures in June do not indicate any worries about the sort of economic collapse that would drag the Nasdaq down and Bitcoin with it. Calls and puts for strike prices at $20,000 and $40,000 are consistent with traders expecting the market to be steady for the next couple of months. However, we would not be surprised to see this situation in options on Bitcoin futures to change as we move into May and the prospects of a US debt default increase, and the potential consequences sink in.

A useful aspect of watching trading in Bitcoin futures and options on Bitcoin futures is that while Bitcoin itself is subject to a large amount of wash trading, that does not happen in trading on the Cboe. Thus, this market can provide a more honest measure of what the future holds for Bitcoin and the rest of the crypto market.