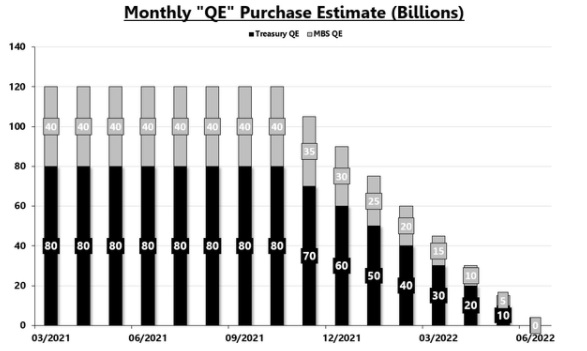

The Open Market Committee of the US Federal Reserve has announced plans to begin tapering off their Quantitative Easing policy of purchasing Treasuries and mortgage-backed securities. This will begin in November 2021. In November monthly purchases will fall from the previous $120 billion per month to $105 billion and in December it will go down to $90 billion. This decision may result in slow economic growth. Our concern is about QE tapering and your investments. When Fed Chairman Powell announced the plan to taper he also noted that there will be no immediate increase in interest rates at least not in the first half of 2022.

What Is Quantitative Easing?

Quantitative easing is a policy used by central banks to increase the supply of money in the economy. This strategy was used to help get the US economy out of the Financial Crisis and has been employed again during the Covid Crisis. This strategy has been used when interest rates were already low thus taking away the most common central bank tool of lowering interest rates when a recession hits. An offshoot of this policy can be inflation which then requires an increase in interest rates. QE tapering is likely to reduce the risk of runaway inflation and/or stagflation.

Does Quantitative Easing Devalue the Dollar?

Pouring more dollars into the economy, which is what quantitative easing does, can reduce the value of each dollar against other currencies. This tends to help domestic manufacturers whose exports become more competitive. It also raises the cost of imported items in dollars. The US dollar fell against a basket of foreign currencies when QE was used by the Fed from 2009 to 2114 for the financial crisis. The dollar rose in that index by nearly 20% when QE was tapered in 2014.

Tapering of QE and the Stock Market

Investors get spooked when they see big moves coming from the Federal Reserve. The saying is that “you can’t fight the Fed.” Thus Fed chairmen and chairwomen have learned to use “Fed speak.” They start early with suggestions about which way they will be taking monetary policy and when they do so effectively the markets don’t get spooked. That is what happened the time where the stock market had already priced in the long-anticipated tapering. The S&P 500 has hit all-time highs.

Federal Reserve Mandates

When wondering what the Fed will be doing over the coming months it is wise to keep in mind the three 1977 Congressional mandates under which the Federal Reserve operates. These are to promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates. Employment has improved since the depths of the Covid Recession but still has a way to go. The path that the Fed needs to follow will be one that does not extinguish the move towards fuller employment and at the same time not let inflation get out of hand. Tapering QE too fast may slow the economy and cause more unemployment while going too slowly could drive inflation higher. With their data-driven approach any coming changes are likely to be gradual and broadcast repeatedly and early.

QE Tapering and Your Investments

Long term investing always benefits from the analysis of intrinsic stock value whether applied to individual stocks or to ETFs that track market sectors or even the whole market. Our opinion at this time is that gradually getting Covid under control and putting the infrastructure legislation into action will both be major drivers for the economy and will thus create investment opportunities beyond the tech sector. We do not see actions by the Fed as likely to cause problems with your investments but are keeping an eye on potential economic problems in China and any potential fallout if the Chinese Communist Party seeks to distract from problems at home with foreign adventurism.