In just a couple of years non-fungible tokens, NFTs, have gone from being unknown to being very popular, an integral part of the blockchain, and potentially profitable. An important factor for profit in NFT trading is recognizing what makes a collectible entity valuable and what attributes are necessary for long term appreciation in value. You do not need to be someone who creates NFTs to get in on the profits but you do need to develop an eye for quality and what qualities translate into profits. NFTs have gone from being unknown to being very popular and potentially profitable as well.

What Are NFTs?

If you are hearing about NFTs for the first time, here are the basics. NFT stands for non-fungible token. Non-fungible means that a thing is unique, cannot be divided. A non-fungible token is a unique identifier in the digital world. It cannot be copied, subdivided, or substituted. It is recorded in a blockchain and can be used to identify digital art, music, or any other digital or digitalized entity. The most popular blockchain for NFTs is Ethereum but NFTs can also be found on Zilliqa, Flow, Tezos, Solana, Cardano blockchains as well as others. Examples of non-fungible tokens range from video clips of NBA highlights to digital art to William Shatner’s dental x-rays! If it is digitalized, unique, and that uniqueness is registered on a blockchain it is an NFT.

Is There Money in NFTs?

The most expensive NFTs ever sold have fetched as much as $91.8 million for the digital work of art, Merge, by a digital artist known as Pak. First 5000 days by Mike Winkelmann sold for $69.3 million through Christie’s digital branch. This simply shows that there is a market in digital art for famous artists. Can you make money if you buy an NFT and later want to sell it? In that case you need to know how to spot NFTs that are likely to appreciate in value.

What Determines NFT Value?

Most NFTs are collectables. The ideal collectable investments would have been a Picasso painting when he was an unknown artist or a Honus Wagner baseball card when baseball cards featuring popular players were given away at the end of the 19th century for buying a pack of cigarettes. Today a Picasso sold at a public auction will fetch more than $100 million and a Honus Wagner baseball card most recently sold for more than $3 million. In both cases the items are rare and unique and have to do with a famous artist or perhaps the best baseball player of all time. To the extent that you have an eye for collectibles you may be able to pick up something unique by an unknown artist and sell it later for a profit when they become famous.

NFTs as Properties

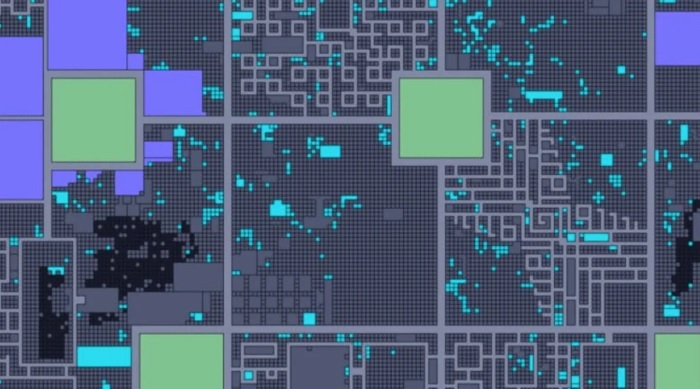

Blockchain gaming has become increasingly popular and it is possible to obtain ownership of “land” in such games. As the game becomes more popular the land may become more valuable as well based on the rules of the digital game. This sort of NFT investment could pay off in a few months or years as opposed to waiting decades or a century for a Picasso or Honus Wagner baseball card to peak in price. On top of that you are probably not a fine art expert and maybe are not interested in old baseball cards. But you are interested in blockchain gaming and have a better sense of what things are worth and how their values might increase or decrease lowest current prices for “property” in Decentraland are in the range of 3.7 ETH for a plot which is just under $7,000 at the current ETH to USD exchange rate. Assets within a game like Decentraland have use within the game and can be sold for fiat currencies outside of the game making them perhaps the best way to profit in NFT trading.

Profit in NFT Trading – SlideShare Version

FREE MASTERCLASS: 3 Secrets to Take Control of Your Financial Future!