A common argument for investing in commodities is that doing so allows an investor to diversify a portfolio that consists solely of stocks and bonds. The most highly traded commodities are crude oil, coffee, natural gas, gold, wheat, cotton, corn, and sugar in that order. Commodity futures trading requires a special set of skills and is not what we are talking about when we look at whether investing in commodities is something that you should do to diversify your investment portfolio.

How to Invest in Commodities

There are five basic ways to invest in commodities. You can buy and hold commodities like precious metals as a hedge against inflation or buy and sell over the short term for profit. And, you can invest in ETFs that track commodities like gold which is a more flexible approach than buying and storing gold bullion. Or, you can invest in commodity producers. For example, when the price of gold goes up shares of gold mining stocks commonly go up faster. And, while the most-traded commodity is crude oil there are big oil stocks to invest in. And, like with commodities themselves there are ETFs that track commodity producers like the oil sector or mining stocks.

Investing in Commodities Via Futures

Professional traders trade commodity futures. It is a high reward and high risk trading arena and it is not investing. What some investors choose to do is put money into ETFs or ETNs that track an index which tracks commodity futures. One such index is the Bloomberg Commodity Index. The index tracks contracts on the following commodity futures.

| Energy | Grains | Industrial Metals | Precious Metals | Softs | Livestock |

| WTI Crude | Corn | COMEX Copper | Gold | Sugar | Live Cattle |

| Natural Gas | Soybeans | LME Aluminum | Silver | Coffee | Lean Hogs |

| Brent Crude | Soybean Meal | LME Zinc | Cotton | ||

| RBOB Gasoline | Chicago Wheat | LME Nickel | |||

| Low Sulphur Gas Oil | Soybean Oil | ||||

| ULS Diesel | Kansas HRW Wheat |

The index is set up so that no single commodity can be more than fifteen percent of the total and no set of derived commodities can be more than twenty-five percent. And, no sector can be more than a third of the index.

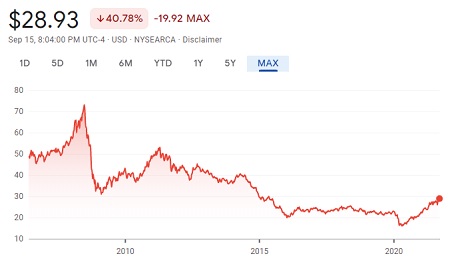

The DJP is an ETN that tracks the Bloomberg Commodity Index. Because it covers 23 different commodities it smooths out some of the volatility of individual commodity futures. Nevertheless, it has lots of ups and downs. And, over the years it has not been a good place to park money for the long term.

On the other hand, if one had invested in this ETN when the Covid-19 market crash bottomed out, they would have doubled their money by September of 2021. Thus, this investing route works better for short term, in and out, investments.

Why Invest in Commodities?

The point of investing is first of all to preserve your purchasing power and secondly to increase it. Many investors add gold bullion or a gold ETF to their portfolio to counter the effects of inflation. While it makes sense to buy and store gold over the years, that does not work with live cattle, sugar, coffee, or crude oil, all of which have “shelf lives.” “Hard assets” like gold, silver, platinum, or palladium offer inflation protection and tend to move in value contrary to bonds and stocks. Thus, these investments are promoted as ways to diversify portfolio risk. What is not mentioned in that argument is real estate fulfills much of the function and can provide you with a place to live or rent out for profit while also going up in value with inflation.

Investing in Commodities – Slideshare Version