The stock market continues to climb and bonds remain in the limbo of low interest rates. There is a tendency for an investment portfolio to get out of balance in this environment. How often should you rebalance in investment portfolio? And, for that matter, why should you aim for a balanced portfolio instead of simply aiming for the best-performing investments?

Rationale for Balancing an Investment Portfolio

Investors balance their investment portfolios in order to balance the potential for return on their investments and the risk associated with those investments. The traditional approach is to invest primarily in stocks when you are young and starting out and to pivot towards more bonds, treasuries, and CDs as you approach retirement. An investor in their twenties may have 90% stocks and 10% bonds while someone in their forties might go with 70% and 30%. Traditionally, someone near or in retirement may have half or more of their portfolio in bonds. While the US stock market has historically returned as much as 10% a year on the average, there have been long periods when the market has slumped and remained down for years. The rationale for balancing an investment portfolio is not to get caught during a market crash and slump with no means of support while you wait for the market to recover.

Do You Really Need to Balance a Portfolio?

Warren Buffett has said something to the effect that people only balance their portfolio because they don’t know how to apply the concept of intrinsic value to pick the right stocks over the long term. That having been said, markets still slump and having a part of your investments in cash equivalents helps you avoid having to sell good stocks to live during retirement because the market crashed. Buffett’s suggestion in regard to those who do not have time or expertise to choose and follow the right stocks is to invest regularly in an ETF that tracks the S&P 500. This approach does indeed help avoid the problem of picking the wrong stocks but not the issue of being stuck 100% in stocks when the market crashes.

How Often Should You Rebalance an Investment Portfolio?

If you are going to follow the traditional recipe for allocating investments to stocks and bonds you will rebalance when it is time to change the mix as you get older and when the portfolio gets out of balance because either stocks or bonds have gotten ahead of the percent of the portfolio that you have chosen. Because the market and interest rates fluctuate normally, it is not a good idea to fuss over this issue every month. But, rather take a look and make changes on a yearly basis.

What Is the Best Method for Rebalancing an Investment Portfolio?

A good reason for holding off on rebalancing every time that the percentage varies a bit is that you would need sell your winners and buy new stocks or bonds to re-achieve balance. The best way to get back into balance is to adjust your purchases of stocks or bonds. If you are way ahead on your stock percentage as many investors are today it is time to invest in bonds, CDs, or treasuries until you have returned to the balance that you desire. One can simply use the dollar cost averaging route with stocks or interest bearing investments for this task.

What Is the Rule of 110?

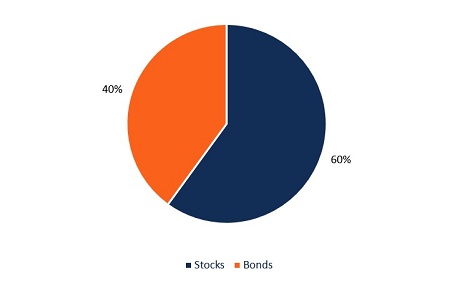

If you are wondering just how much of your investment portfolio should be in stocks versus bonds, treasuries, or CDs, considering using the rule of 110. Take your age and subtract it from 110. If you are 30-years-old the rule of 110 will tell you to put 80% of your portfolio into stocks. If you are 60-years-old the rule of 110 will tell you to allocate 50% to stocks and 50% to interest-bearing investments. Investors have used this approach for decades. It is still in use because it keeps your portfolio from being top heavy with stocks at the end of a bull market when the risk of crash is high. And, it gets you back into stocks as a bear market is bottoming out and you can find bargain stocks for the next bull market.

How Often Should You Rebalance and Investment Portfolio? – Slideshare Version

How Often Should You Rebalance an Investment Portfolio? – DOC

How Often Should You Rebalance an Investment Portfolio? – PDF