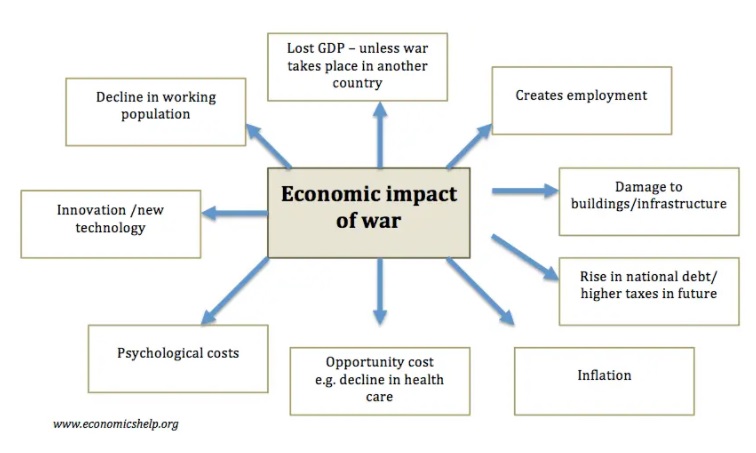

As Russia’s invasion of Ukraine continues the news is full of death and destruction. Refugees leave their homeland. As this plays out we consider the economic impact of war. Shortages occur, inflation ramps up, infrastructure is damaged or destroyed, normal commerce is interrupted, and combatants go into debt. Over the longer term deaths in war lead to a smaller working population and an economic depression that can last for years after the last shot has been fired.

Opportunity Cost of War

War often speeds up innovation and provides profits for defense contractors. When a war is not in one’s home country and the damage occurs somewhere else whole sectors of the economy may benefit. However, money spent in pursuing war could have been used for other purposes. When President Obama announced troop withdrawals from Iraq in 2009 the US had spent $860 billion on the war there according to The New York Times. The nation was in a Financial Crisis and the argument went that the crisis would have been less severe or might not have happened if the $860 billion spent on the Iraq war had been spent on things like improving American infrastructure. The opportunity cost of war is the price a nation pays for not having done useful things like funding education, research and development, and prenatal care for the poor which would provide benefits for decades to come. The total cost of wars in Afghanistan and Iraq from 2001 to 2021 was about $6.6 trillion. By comparison in 2021 Congress haggled over spending less than a trillion to beef up US infrastructure over the next decade!

Impact of War in Invaded Countries

When a country like Ukraine is invaded it suffers widespread damage to its infrastructure that will take decades to rebuild. If the country loses territory and assets they also lose the income stream to pay to rebuild infrastructure. To the extent that the country prints money to pay for the war it can lead to hyperinflation. When a country succeeds in its war there can still be inflation because total mobilization and total employment super heat the economy.

War and the Price of Oil

Wars often threaten oil production or transport thus driving up prices. In the case of the Russian invasion of Ukraine, sanctions on Russian banks and not buying their oil will allow other oil producers to charge more. In the longer term European dependence on Russian oil and natural gas will diminish but in the shorter term European economies will have to choose between rationing and paying more for their energy from other suppliers.

Increased National Debt As a Result of War

As noted in a 2016 issue of The Atlantic, debt service on the bill for fighting in Iraq and Afghanistan will eventually exceed the direct costs of the war. The decline of the United Kingdom from the dominant global power to its current status came largely from the debts heaped on its economy by World War I and then World War II. It took decades for the UK to pay off debts to the USA from the Second World War. If Ukraine survives this crisis it will take decades to repair the damage inflicted by the Russians. And, the Russians may never recover financially from the sanctions and isolation they must now endure.

Collateral Costs of War on Non-combatant Nations

We already see how war in Ukraine is causing millions of refugees to flood into Poland, Germany, Hungary, Slovakia, Romania and Moldova. In the longer term refugees integrated into these economies could be beneficial but in the short term they will have to bear the cost of housing and feeding those fleeing the war. Ukraine is a major supplier of grain to Africa (40.7%) and Asia (55.1%) with the largest recipients being Yemen, Turkey, Bangladesh, Egypt, and Indonesia. A country like Bangladesh can ill afford to pay more for grain from other sources or go without as a collateral cost of Russia’s invasion. We can expect NATO to move troops and arms to its Eastern European members to forestall further Russian adventurism. This will result in ongoing costs borne by all members of NATO. Germany is beefing up its military as will other NATO member states.

Impact of War on Investments

The world is confronting serious challenges such as Covid-19, supply chain disruptions, steadily rising temperatures, extreme weather, inflation associated with economic recovery, stressed infrastructure in many nations and now an invasion of a neighboring country by a mad man who is sentencing soldiers and civilians to death to satisfy his own ego. All of the money going into providing arms to the Ukrainians and arms being used by the Russians could be used for useful purposes. Think of this conflict as taking a trillion dollars or so and burning it. The misuse of such a vast amount of capital will have detrimental effects for years to come.

Economic Impact of War – SlideShare Version