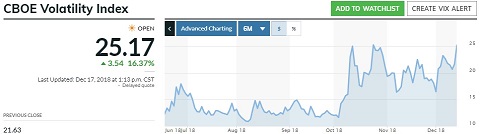

The stock market has been in a selling mood for the last two weeks and the bears are predicting more of a selloff. The VIX indicator of market volatility is roaming in the low 20s which is higher than the teens where the CBOE volatility indicator resides during periods of no market turmoil. As market falls it would appear that many investors have decided to take a little profit while others are buying in expectation of a rebound. The question is if this is the start of a long term slide, a more substantial market correction, or just a bump in the road to high stock prices. Simply looking at the elevated VIX the question is this. When investments are volatile should you sell or buy?

VIX as a Measure of Volatility

What is the VIX and is it important to your investing? Investopedia explains VIX.

Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments. It is also known by other names like “Fear Gauge” or “Fear Index.” Investors, research analysts and portfolio managers look to VIX values as a way to measure market risk, fear and stress before they take investment decisions.

When the market is going up or staying the same, the VIX is low. When the market is falling the VIX goes up. As an example, at the end of 2008 the VIX went from a normal of 18 up to 81 over a couple of months as the market crashed. The calculation for the VIX is complicated but what it is looking at is puts versus calls as a guide to investor concern.

The VIX is not the only indicator of market volatility offered by the Chicago Board Options Exchange. Others are these.

Cboe ShortTerm Volatility Index (VXSTSM): S&P 500 expected volatility next 9 days

Cboe S&P 500 3-Month Volatility Index (VXVSM)

Cboe S&P 500 6-Month Volatility Index (VXMTSM)

The usefulness of VIX and its relations comes from its “canary in the coal mine” property of predicting a falling market based on the actions of option traders. But, let’s get back to our question. When investments are volatile should you sell or buy? And, is the VIX useful in this regard?

The Importance of Recognizing Market Volatility

The Motley Food writes about why you should care about the VIX.

Some have dubbed the VIX the “Fear Index” because of its tendency to rise when the market drops and to decline when the market rises. Even though traders tend to interpret high VIX levels as danger points, long-term investors can use a high VIX reading as a signal to look more closely at stocks. Once the VIX has risen, some stocks might have had their share prices beaten down already, and others might have higher chances of falling to attractive levels than usual. Using the VIX as an early warning system to start looking for bargain opportunities has been a smart strategy over time, especially in recent years when long periods of low volatility were the norm rather than the exception.

We often suggest the use of intrinsic stock value as an investment guide. When a stock has been beaten down by a fearful market its intrinsic value is often the same as it was before the market panicked. Successful long term investors very often buy into a decline in stock prices in order to pick up bargains for the long term. They are not necessarily expecting the entire market to recover all that soon but the specific investments they buy are those with long term value based on fundamental analysis.

So, a high VIX indicating volatility is not a direct indication to buy but it is an indication that you should look more closely at high intrinsic value stocks that have taken a beating. A reassessment of intrinsic value may be in order. And a laddered approach of buying in increments is a good idea because nobody can precisely time the market. That having been said, when the market has fallen and then VIX falls as well, this is an indicator or stable or rising stock prices.

Why Is the Stock Price Doing What It Is Doing?

We are looking at a technical indicator, the VIX, and suggesting that you use it to carry out fundamental analysis. Why do you need to use both tools? Although markets tend to panic, they often do so for good reasons. The fundamentals, like a trade war, can cause real damage to otherwise healthy companies. We wrote about how the trade war damages investments in agriculture. When an elevated VIX tips you off to look for high intrinsic value stocks, make sure that the fundamentals that are helping drive down the overall market are not ones that will do lasting damage to your chosen investment. In the case of the trade war with China US soybean growers are concerned about the long term loss of a major buyer. Thus, when the VIX goes up and you go hunting for bargains, make sure that your assessments and calculations of intrinsic value are based on current information.

Can You Trade the VIX

Investopedia mentions in their VIX article that VIX-linked securities can be used to hedge risk and balance a portfolio.

Active traders, large institutional investors and hedge fund managers use the VIX-linked securities for portfolio diversification, as historical data demonstrates a strong negative correlation of volatility to the stock market returns ,that is, when stock returns go down, volatility rises and vice versa.

This may be a more sophisticated approach than many mom and pop investors choose to follow but it does indicate the use of this tool beyond its “canary in the coal mine” value. But, if an investor wishes to try this approach it can be a stabilizing factor in their portfolio.