Over the long run investing in the US stock market is an excellent way to grow a nest egg. However, one can potentially make more money by accurately buying and selling stocks over the short run as the day by day, week by week, and month by month market fluctuations come to more money that a slow and steady appreciation of stock price. The tricky part is accurately forecasting short term price changes. While you can make good money buying and selling as you try to time the market you can also pile up huge losses in doing so. One of the ways that traders deal with the risks of the market is by trading options. There are, in fact easy and profitable options strategies for those willing to make the effort.

What Are Options?

Options are contracts in which the buyer of the option pays for the right to buy or sell an asset like a stock on or before a future date at a specified price. The buyer pays a premium for this right. The seller takes on the obligation of fulfilling the contract if and when the buyer desires. In return for taking on this risk the selling is paid a premium. A contract to buy an asset is a call contract and a contract to sell an asset is a put contract. The most basic reason for buying an option is to limit one’s risk. The point of selling an option is to earn a guaranteed return specified by the contract. The buyer will only enter into a call contract if he or she believes an asset like a stock will go up in price. The seller will only sell a call if they believe that the price of the asset will not rise to the contract price. A person buying a call has the potential for large profits with a fixed limit to their losses. Options sellers generally make more money than buyers because they only enter into contracts where the odds are in their favor. However, an options seller always has a potential for a huge loss should the asset price move rapidly and significantly contrary to their expectations. If you are interested in trading options it is wise to start with the easiest contract to understand and the ones with the least risk.

The Long Call Option

If you are long on a call option it simply means that you bought the call contract. This is an option contract where you expect a stock or other asset to go up in price within a given period of time. What you pay for the contract will depend on the likelihood of the price going up to the level of the contract price. This is a simple approach. You will typically not make much on most such call contracts but your risk will also be quite small. The risk, of course, is that the stock price does not go up to the level you expected and you simply lose the premium that you paid. If the stock price goes down instead of up you are still out the premium but that is a much better deal than if you had bought the stock and had to absorb the loss.

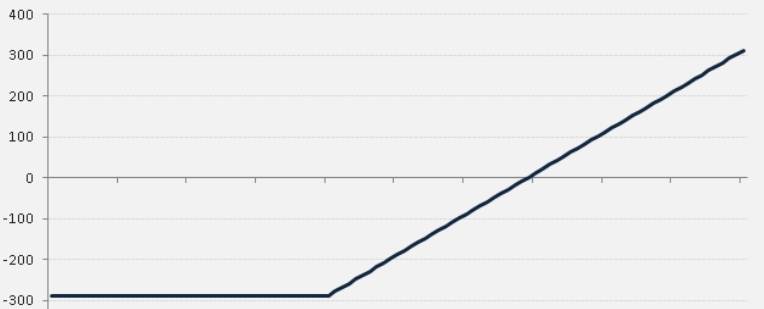

Long Call Option Payout

The Covered Call

This is a situation in which the owner of a stock offers to sell it. They will earn a premium paid by the buyer no matter if they purchase the stock or not. The risk is that the stock will go up in price and the owner will have to sell it at the now lower contract price instead of the market price. Because the owner is familiar with the stock they will typically only enter into a contract for a price that is unlikely to be reached within the time frame of the contract. Doing this repeatedly and not having to sell the stock is akin to collecting dividends on the stock.

The Married Put

In this case the owner of a stock has seen his or her investment go up significantly in price but the market has weakened and there is the risk of the stock falling to a much lower price. Here the owner buys a put, the right to sell, on his own stock. If the bottom drops out of the market he or she will still receive the contract price of the put option thus avoiding significant losses. This approach requires the owner to pay a premium for the ”insurance” they are purchasing.