We recently wrote about easy and profitable options strategies. For anyone who is familiar with options we offered useful advice. But what if you really do not know much about how options work or why you might want to use them as part of your investing and trading strategy? There are great benefits to trading options if you know what you are doing and proceed efficiently. There are also potentially very big risks. Here is a little info to help you understand just why options might be something for you to consider.

Options Trading Benefits

The first thing one generally thinks of with options is that they help you hedge your risk. However, they also offer an opportunity to leverage your investment and trading capital. Here is how.

Options Trading Benefits

Let us say that you think stock XYZ is about to go up in price. You buy the stock. It may go up, stay the same, or fall in price. If it goes up you have a more valuable stock which you could hold on to or sell. You will have paid fees and commissions to buy the stock. If it does not budge in price you are still out the fees and commissions and still have the stock. If the price goes down subsequent to you purchase you are out fees and commissions and have lost money on the stock should you decide to sell it at the current price. What happens if you use options? If you buy a call option on the stock you will only end up buying it if the price goes up to the price of the options contract. This will cost you the premium as well as fees and commissions. However, you will purchase the sfock at a price less than the now current market value. If you choose to simply sell your now more valuable options contract you will earn something very similar to having bought and sold the stock but will have only invested the premium and not the price of the stock itself. This is your leverage!

Options to Limit Trading Risk

If in the previous example your stock went down in price instead of up, you will have save a significant amount of money because you would not have purchased the stock but simply would have paid a premium for the option to do so, which you obviously did not do. Over time one makes money buying call options if they choose stocks wisely in regard to the stock’s potential for appreciation and in regard to the price of the premium

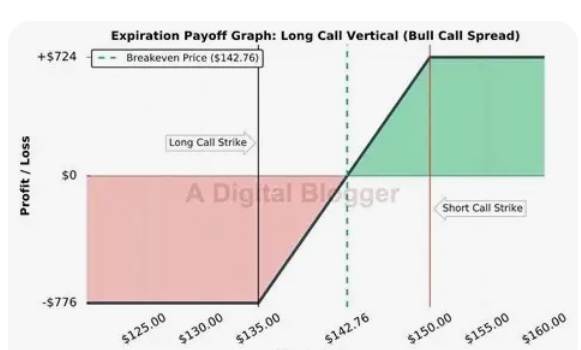

Bull Call Spread Payout Diagram

How Professionals Trade Options

One is not limited to trading one type of option at a set price for a given stock. Professionals buy and sell options on a stock at the same time. They may choose different contract prices as well. Many times they are not looking to hit a home run with a given trade but to improve their odds of reliably making money each and every time that they compose a set of options trades. As a rule selling options is more profitable than buying them. A typical approach is the Bull Call Spread as noted above. In this case, a professional will typically balance a complex trade by adding a purchase to protect against even the remote possibility of huge loss in case a stock unexpectedly plummets in value. Nobody with any sense just sells options routinely without a offsetting purchase to protect themselves against catastrophic loss.