As the economy weakens it becomes increasingly likely that the US Federal Reserve Open Market Committee will lower the Federal Funds target rate range. That rate cut will transmit throughout the economy with lower rates across the board. What will happen to Bitcoin when interest rates fall? There are two aspects to consider in this regard. The first is that investor appetite for risk generally goes up when rates are lower. The second is that the reason for a rate cut would be a weaker economy which could hurt Bitcoin.

Is Bitcoin Ready for Another Rally?

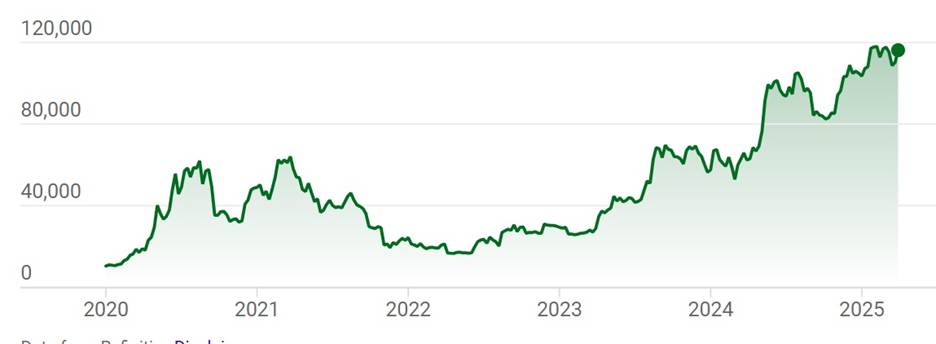

Crypto winter has receded sufficiently from the short term memories of many crypto investors. As such we are seeing predictions of Bitcoin heading up to the million dollar range. It currently trades in the $115,000 range, which is substantially above its crypto winter lows. Bitcoin has always been subject to a herd mentality. As such, it is quite possible that a rally that feeds on itself will occur and drive the price of Bitcoin much higher such as with other rallies.

Could Bitcoin Be in Trouble When Rates Fall?

Bitcoin has reliably traded in tandem with the Nasdaq. Bitcoin’s relationship with markets changed to a positive one in 2020 and has continued. Thus, a weaker economy which would drive down the Dow Jones Industrial Average, the Nasdaq and the S&P 500 would likely also drive down the price of Bitcoin. Such as price dip would last as long as the weakened economy and be accompanied by steadily lower interest rates.

Why Has the Economy Weakened?

Several factors have conspired to weaken the US economy. They include tax cuts and higher spending, massive tariffs on a wide range of things that US consumers routinely purchase and generally unpredictable economic policies from the current administration. Add to this the efforts of the Trump administration to exert direct authority over the US Federal Reserve and we have a huge loss of confidence in the US dollar sending the dollar downward against foreign currencies. All of these factors have the outside potential to result in a economic collapse more on a par with the Great Recession than the Financial Crisis of 2008. Equities and Bitcoin, should its correlation with Nasdaq continue, would not be spared the paid of such a collapse.

The Strength of Bitcoin

What Bitcoin has, that the dollar does not, is a firm limit to how many will be mined. We are almost at the 21 million limit. So, should the Trump administration to follow the route of the 1920s Weimar Republic (Germany) and print more money to try to support the American debt when nobody wants to buy Treasuries, we could see the dollar plummet further while Bitcoin retains its value. That would be a rally by default but a rally non-the-less.

Does Bitcoin Belong in Your Investment Portfolio?

If you are a Bitcoin true believer Bitcoin is all that you invest in. Other investors will look at Bitcoin as a somewhat risky investment with the potential for spectacular gains. As such they will allocate a small portion of their portfolio, such as 5%, use dollar cost averaging, and remain invested in Bitcoin over the long haul.it

Bitcoin Risk

There are two basic risks with Bitcoin. For investors the risk is buying into the constant hype that all too often is part of pump and dump schemes. The risk for traders is the ongoing use of wash trading which causes the appearance of a rally in the making and encourages novices to buy only to see value of their purchases fall in the very near term. As such, one may choose to buy and sell Bitcoin but one needs to be aware of the potential problems in this market from short term price manipulation to risk of substantial losses is the economy goes bad!